Al Sunderji

Contact Info:

About

Languages:

Explore Our Services

Preview Our Rates

Access all your mortgage options with just one application. Preview today's rates first:

Our Lenders

Testimonials

Amazing service, my clients are very happy. Al has helped numerous clients get into home ownership. He is compassionate, committed and educates clients on the entire process. His care and expertise are second to none.

Adil Vellani

2 years ago

Blog

RBC expects no further BoC rate cuts

July 10, 2025

Written by Steve Huebl

July 9, 2025

Mortgage Digest: RBC expects no further BoC rate cuts

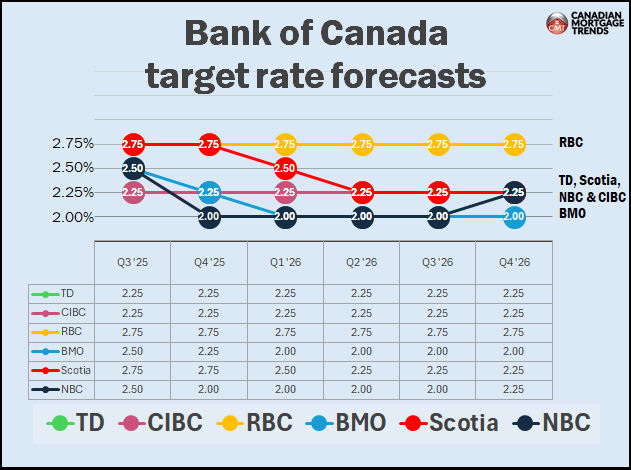

Canada’s big banks are divided on how much further the Bank of Canada will cut, with RBC now saying the rate has likely bottomed, while others still expect more easing ahead.

The outlook for interest rates is becoming less clear-cut as Canada’s major banks rethink how far the Bank of Canada will go in its rate-cutting cycle. While most still see room for further easing, RBC is breaking away from the pack.

The bank has taken additional cuts off the table, forecasting the overnight rate will hold steady at 2.75% through 2026—making it the most hawkish forecast among the Big Six.

In its latest Monthly Forecast Update, RBC said: “We no longer expect any rate cuts from the BoC this year.” The bank explained that “as direct trade uncertainty facing Canada recedes…the inflation outlook remains uncertain,” reducing pressure on the central bank to act further.

That’s a shift from earlier this year, when RBC still expected one more cut before the cycle ended.

By contrast, Scotiabank has revised its forecast lower, now projecting the policy rate to settle at 2.25%—down from 2.50% in its previous estimate. BMO, meanwhile, remains the most dovish, continuing to project a fall to 2.00% by early 2026.

TD, CIBC and National Bank continue to expect a terminal rate of 2.25%, in line with the Bank of Canada’s current inflation outlook.

Navigating Uncertainty: How trade tensions could impact mortgages, housing, and rates.

July 09, 2025

Newsletter – February 2025

Navigating Uncertainty: How trade tensions could impact mortgages, housing, and rates

With trade wars and tariffs dominating the headlines recently, many are wondering what effect this could have on the housing market. Lower interest rates offer some relief but we're now facing the potential of tariffs driving up costs. So what does it mean for mortgage rates, home prices, and affordability? Here's an overview of how tariffs could impact the housing market:

In late January, the U.S. announced that it would impose tariffs on certain Canadian goods, which prompted retaliatory measures from our government. Then, in an eleventh-hour deal, both countries agreed on a 30-day suspension. More recently, the U.S. announced that it would impose a 25% tariff on Canadian steel and aluminum imports. With the threat of more tariffs still looming, the situation remains unclear.

If tariffs do go into effect, this could lead to higher costs in construction, home renovations, and mortgage rates. Here’s what’s already unfolding:

· The Canadian dollar has seen drops, making imported goods, including construction materials, more expensive.

· Stock market fluctuations indicate general unease about economic stability, affecting investor confidence and borrowing conditions.

How Could Tariffs Impact the Housing Market?

1. Higher Construction and Renovation Costs

- Many materials used in Canadian homebuilding are imported from the U.S. If tariffs increase costs, this could lead to:

- Fewer new homes being built, further tightening supply

- Rising home prices due to higher material costs

- More expensive home renovations for current homeowners

2. Mortgage Affordability and Interest Rate Uncertainty

On January 29, the Bank of Canada announced its sixth consecutive rate cut to support the economy. Further rate cuts in 2025 were widely expected but some analysts suggest that tariffs could lead to inflation, which might pressure the Bank of Canada to halt or reverse rate cuts. Others argue that economic slowdowns resulting from trade disruptions could lead to further rate reductions.

3. Market Volatility and Buyer Behavior

Uncertainty surrounding trade policies could lead to mixed reactions in the housing market:

- Some buyers may rush to secure lower mortgage rates before potential increases.

- Others may pause their homebuying plans, waiting for greater economic clarity.

- Regional markets may be affected differently, with some areas maintaining demand while others slow due to affordability concerns.

What Does This Mean for You?

If you have a variable-rate mortgage: The recent rate cut means lower payments for now. However, if inflation rises due to trade disruptions, further rate cuts may not materialize, and rates may even increase.

If you have a fixed-rate mortgage: Refinancing might still be a good option while bond yields remain low, but market uncertainty could impact lender rates.

If you are planning to buy a home: Rising construction costs could mean fewer new homes and higher prices. Acting sooner rather than later could help secure a better mortgage rate and affordability.

How to Stay Ahead

The housing market is evolving rapidly and having the right mortgage strategy is more important than ever. Whether you're looking to buy, refinance, or explore your options, I can help you navigate these changes with confidence.

Let’s discuss your mortgage strategy before conditions shift! Call or email me today to plan your next steps.

Stay Connected

Stay in touch to ensure that you get the best rates, always!